In the rare occasion, I find myself at a dinner party. Shortly after introducing myself and exchanging pleasantries. The question always arises as soon as I share my profession. What do you think about Apple? Is Microsoft still a good company? What about Snapchat? Or Facebook? Is Bank of America a good bank to invest in? Is this a good company?

After I am forced to give a short explanation about why Apple will do well with the launch of their new phone. Or why Microsoft will dominate cloud infrastructure. People still feel a bit uneasy about pulling the trigger on an investment. Most of us do not think twice about buying a new pair of expensive sun glasses, or a pair of $1000 shoes, but for some reason, buying a few shares of Facebook makes the hair in the back of our necks stand up.

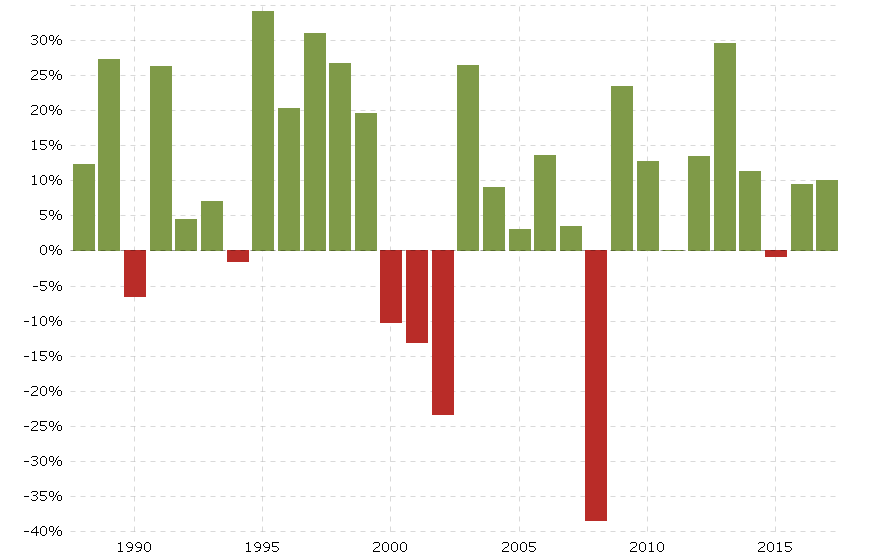

I do not blame you for feeling perturbed for investing in the stock market. We tend to remember the last famous crisis in 2008. The market was cut by 37% during that time. People lost vast amounts of money during those days, and that can make anyone feel uncomfortable placing their hard-earned cash in a stock. Still, if you would have stayed the course, and done absolutely nothing, you would have increased your money by double.

I understand it is hard to stay invested when you wake up every day and see your portfolio swimming in a sea of red. Most people would sell at this point. Most people would be wrong to do so. Once you sell you can never make up what you lost. This recent bull market is the prime example. Let me show you a chart of the historical returns for the S&P during the last 3 decades. I’ll let you be the judge.

Now that you have seen what happens during and after a down-turn in the market. You can adjust your expectations accordingly. You will not be able to make money on every single trade or investment you make. But you can identify when you have a winner or a loser. You can figure out if you should buy the recent dip or if you should sell the recent spike.

How can we identify a good stock from a bad one?

Often times we come across a product or service we like. I’m sure some of you own an iPhone, use Instagram or Facebook, shop at Amazon, or hunt for bargains at a Ross Stores or T.J. Max. The first and easiest step in identifying a good investment from a bad is being a customer. Pay attention to how their customer service department handles its customers. Pay attention to the quality of the product you’re buying and how satisfied you may feel after buying. Would you buy from that company again? If you like what you see, and enjoyed being a client. The next thing you should consider is, “Can I invest in this?”

Assuming the company in mention is publicly traded. We can easily find out how it’s doing. Pull out your smartphone or PC and type a quick search for the company’s ticker name. Once you find it, you can use any of the free financial sites out there to search for a chart of the company’s stock price and financial statements. For the most part, this information is available for the last 3-5 years. Read all the news articles and analyst reports you can find. Get yourself familiar with what others are thinking and saying about the company. I like to look at both aspects. The good and the bad. That way you will have the ability to make an informed decision. In this game, the more information you have, the better.

After reading all the news articles you could find and analyst reports. Stop, and think about what arguments you agree with and which arguments you do not. Weigh the negatives and the positives. If you feel like this company has a good future and you could find arguments to support that view. You are ready to dig a little deeper.

The aspects I like to look for in any particular company are as follows:

- Brand recognition and loyalty.

- Good customer service and customer retention.

- Innovative initiatives (is it still relevant today?).

- Competition landscape (the less competition, the better).

- Barriers to entry (can they keep others from steeling market share).

- No recent legal and/or accounting issues.

- Can you understand the business?

- What about this company makes you excited?

- Is it diversified or does it dominate its industry?

- Does management seem honest and eager to continue innovating?

- Is it a disruptor or is it being disrupted? (stay away from the disrupted)

In the next part, I will go into what to look for in financial statements. That is usually what I like to do after I determine if I am interested in any particular company. Prior to digging into a company’s financial statements. Write down 3-5 reasons why you want to buy any particular stock. If you are not able to find at least 3. That means you should look for other opportunities. I will explain why this is crucial in my next post. Do your homework. 😊

This is insightful and timely!